After a series of summer meetings, CMS has released its proposed prices for new lab test codes, to be effective 1/1/2023. CMS accepts public comment to October 24, and will release "final" prices in November.

Because the CMS link may update and change, I'm providing the link to the CLFS public meetings webpage, where you can scroll down to find the CY2023 proposed prices, as a Zip file holding an xls file.

https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/ClinicalLabFeeSched/Laboratory_Public_Meetings

About 100 Agenda Items

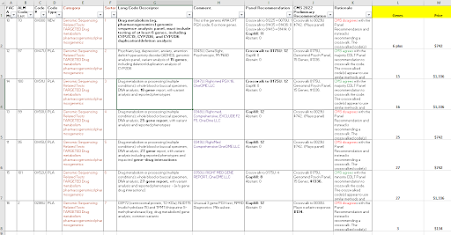

CMS had 105 agenda items, including a number of reconsidered (appealed) codes and including 1 code that is automatically priced as an ADLT test, the Natera minimal residual disease test.

By my tally, CMS recommends gapfill 22 times, which is about half of last year's rate. CMS recommends a crosswalk for the other codes (90-plus), of which just two are crosswalk multiples (rather than crosswalk 1X). (*)

CMS appears to agree 76 times and disagree 27 times with the expert panel which voted in July. However, CMS counts an "agree" if it agrees with anybody or any subgroup on the panel. In about 19 of those 76 agreements, CMS actually disagreed with the majority, but did agree with a minority of the panel.

A Few Notable Codes

PGX

See my follow up blog on the 7 PGX codes here.

CSF Amyloid Test

The worst surprise for me, and a red flag for anybody working in proteomics, CMS proposes to price a novel plasma-based amyloid test Beta 40/42, at only $24. (There is an FDA authorized Fujirebio CSF test, and applied for a PLA code for it to be issued 10/2022, but this particular code is an LDT from Quest). Panelists had all recommended gapfill for the Quest plasma amyloid code - CMS spreadsheet code 0X48U (permanent code 0346U).

An even worse policy issue for CSF amyloid tests, is that the great majority of all CSF procedures today are from hospital outpatient or inpatient environments, where CMS (to my knowledge) bundles clinical chemistry tests to the procedure cost.(**)

For another example of pancreatic proteomic biomarker test much lower than genomic test, see "pancreatic test" section below.

Tumor/Germline WGS = Germline WGS

A code for matching tumor/germline whole genome 0297U, is simply crosswalked to the price of the genome alone, 81425 (about $5000).

OGM: Optical genome mapping.

Two codes for optical genome mapping are both set for gapfill (0299U, 0300U).

Castle Melanoma Test

A majority of panelists recommended crosswalking Castle's new code 0314U to its own prior ADLT code 81529 (about $7000). However, CMS went with a minority crosswalk to 0090U, which is only $1950.

Pancreatic Risk Tests

There are two in this cycle. PANCRESEQ (U Pitt) 0313U, 74 genes, crosswalk to thyroid test 0026U, 112 genes. $3600.

In contrast, a proteomic test, Immunovia IMMRAY (Marlborough MA) PAN CAN D 0342U, about 5 biomarkers, crosswalk to 81503 (a multi marker ovarian test), only $897.

81439: CPT Code for Low-Coverage NGS Cytogenomics

A code for low-coverage NGS for cytogenomics 81439, is set for crosswalk to 81229 (microarray). This code is currently in the MAC gapfill process at prices that basically come very close to the 81229 price.

The final MAC gapfill price will be published any week now, but if the November CLFS decision is crosswalk to 81229 due to the appeal, that will override the year's worth of MAC gapfill process.

Tumor Panels = Either $600 or else $3000

A range of tumor panels with PLA codes are crosswalked to either 81445 (5-50 genes) or 81455 (51+ genes), maintaining the two distant price points (one around $600, one around $3000). See agenda 28 forward. I wrote a white paper on CGP pricing last winter, here.

PGX

See my later blog just about this.

Quite a few PLA codes, item 8 forward, for pharmacogenomic panels. CMS proposed to crosswalk the AMA CPT panel 8X000 for at least 6 PGX genes, to 0029U = Mayo PGX panel = $742.

However, there are a few of the multiple PGX panels that are not crosswalked to 0029U $742, but rather crosswalked to 0175U (Genomind) which is $1336. This is true for 0345U (Myriad Assurex), agenda 12, 15 genes. (Bottom line, Myriad is much better off with its own code 0345U than being coded under the generic CPT code 8X000.) However, I believe the $1336 crosswalk is a bit lower than the current MolDx price, which in turn, is lower than the MolDx price of several years ago.

Metagenomics/Pathogens

A Hopkins-proposed code for CSF metagenomics 0323U is proposed as crosswalk to the Karius code 0152U (agenda 48). (Typo here, CMS says it "disagrees" with the panel, but it "agrees.")

For what it's worth, my Excel with some copying and counting and highlighting is in the cloud here.

CMS Had Requested Public Comment on Crosswalking to an Unpriced Code Being Gapfilled

The context for this section is new code 0324U (#78, and 0325U #79), oncology, ovarian, spheroid cell culture, 4 drug panel. The panelists noted on their own that codes 324/325 are very similar to 0248U, to which it could be "crosswalked." (They're all the same comapny, Kiyatek). However, while 0248U is "on" the fee schedule, it has 0 national price and is currently being "gapfilled." (At $2698). Since the company knows its two codes and two tests are nearly identical, it's in the company's interest to speed the process and just crosswalk new 0324U to slightly older code (not yet finally priced) 0248U.

The panel also recommended that FACA Item 8, 0229U, optical genome mapping, be crosswalked to 0264U, and that FACA Item 9, 0300U be crosswalked to 0267U. Both 264U and 267U are in the current gapfill process.

The question of whether you can "crosswalk to a code in gapfill" is somewhat mooted because CMS proposes to crosswalk 0324U 0325U to 81535 plus 81536x3 (this is a defunct code for Helix for in vitro drug test culture, including 1 base drug and 3 add on drugs, $580 + 3x$178, $1100, a fraction of the in process gapfill of 0248U at $2698).

|

| click to enlarge |

CMS can crosswalk new tests to the price of tests already on the CLFS. Almost every summer, for years, someone asks if they can crosswalk to a code on the fee schedule (published by AMA) but not yet priced because it is in the gapfill process. CMS has said no.

Until this summer, when, CMS said provisionally that yes, you can crosswalk a new code to: a code on the fee schedule but not priced because it is in the gapfill process this summer.

The example was a lab that had gotten a PLA code last year, which was in the midst of being favorably priced this summer. And they wanted to crosswalk their own, even newer code, to that code in the gapfill process. CMS said "OK" but asked for public comment. Such a code is, in fact, "on the fee schedule" but in a very limited since, since it has no fee schedule price.

In the case at hand, it seemed reasonable for a lab to ask to be crosswalked to its own prior code being gapfilled, since the two tests were versions of one another.

However, I'm equally sure that this could go wrong in several ways, if made into a general rule.

First, CMS asks for the price of the code for which a crosswalk is requested. This can't be provided if the target is a yet-unpriced crosswalk code.

Second, CMS can only crosswalk to codes "on the fee schedule," but surely this meant, codes with prices on the fee schedule. Literally, really, "on the fee schedule." With a fee.

But third, the gapfill process code could go haywire in some cases.

Let's say a lab gets a PLA code, and the lab doesn't show up for the summer meeting. Therefore, CMS punts the code to gapfill, because it has no idea (except a few words of code text) what the code is. The lab also submits no information to the MACs for gapfill (maybe the lab is not even in business any more), or, the lab does a really really bad job of providing information. So the code is enroute to being priced very, very low.

The issue of crosswalking to defunct or never-launched PLA codes is a real one, and applies to the crosswalk suggested by CMS for new 0324U (81535+81536x3). I believe that test is no longer in business.

Now, you enter the picture. And you have a brand new CPT code you've worked hard for, maybe even a Category I code. And CMS decides to crosswalk your proud new code to the yet-uncertain, but likely horribly low, price of this gapfill code. Ignoring all the info and arguments you're submitting, or could submit if gapfilled yourself next year. In this situation, the lab with the new code - you - would be really upset or even face bankruptcy, but might have no recourse. So I suggest that crosswalked to a currently "gapfilled" and thus currently price-less code is not necessarily a good idea.

NOTES

*

CW multiples. Agenda 24, 0229U, gets 81327x2 CW. Agenda 102, 87428 gets CW to 78430+87400x2. No multiple, but two codes added, for agenda 47, 0321U, 87633+87632. And agenda 51, 0X55U, 87491 + 89591.

**

Nerd note. The CMS hospital outpatient date of service rule applies equally to pathology tests, and clin lab tests. However, after the DOS rule is applied, the clin lab tests are generally bundled to an event like a procedure or office visit or ER visit, while the pathology tests crosswalk into hospital outpatient "APC" prices that do pay separately, in four tiers.

***

Nerd Note. A code could be crosswalked to a code priced on the fee schedule, but, at the same time, that target test stakeholder could be appealing to be repriced by gapfill. So the code could be crosswalked to a code fully on the fee schedule this summer, but, switched to "no price" = gapfill, next January. Just a hypothetical.