|

| The Secret Document You Need |

On September 29, 2023, the FDA released a grand proposal to regulate all LDT tests - my primary blog here. I also wrote a sidebar blog excerpting some of the legal arguments (I'm not an attorney; I pulled quotes), here. In another sidebar, I asserted that FDA had won the PR game Friday; see how and why, here.

My title of this sidebar blog "The Secret Document You Need," is a bit towards click bait; the document isn't literally secret, but it's buried pretty deep and few stakeholders will find it easily.

In the FDA proposed regulation, FDA provided very brief teasers about its economic analysis, which is super-favorable to the massive economic benefits of regulation. I expected to find several pages summarizing the key issues and methods at the end of the rule (that's how CMS writes rules), but there's nothing there. Instead, see "footnote 34" of the primary document, which links to a web page at FDA, where you can download a 127-page PDF, which is a "preliminary economic analysis." I talk about these 127pp here, but I urge you to read the supplement because it has more twists and turns and easter eggs than I can summarize.

https://www.fda.gov/media/172557/download?attachment

Big Idea

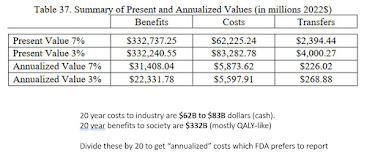

The main rule highlights that there are $2B to $60B of health benefits (per year) and only $5B per year of costs.

First, the costs are real (PMA costs, clinical trial costs, etc). The benefits are mostly virtual (such as $2M per patient in lifespan and QALY-like benefits, about $500K per year x 3 years).

Second, either because of or in spite of holding an MBA with numerous accounting and finance classes, it took me some time to confirm what "annualized costs" are. FDA ran costs out to 20 years (years 10-20 are basically static numbers). They added up all the costs and discounted them to net present value at either 3% or 7%. So far I understood (it's an NPV 101 calculation).

Then, they divide the total costs (or benefits) obtained by 20, since it was a 20 year projection (Supplement, table 35). This shows lots of industry costs in the first 5 years (around $40B dollars), but despite ongoing industry costs of $4B per year, these industry costs are washed out by the "health benefit value" of $26B to $40B a year, every year, forever. So the "annualized benefit" or "annualized cost" is, in fact, the twenty-year table of costs, discounted backwards before dividing by 20 to make it "annualized."

And by the way, the benefits as early as year 3, when we have just adverse event reporting, will be as high as $22B dollars. (Of health value, that is).

For me the key is Table 35, the benefit and cost (to industry) by year. How FDA staffs up for $3B IVD labor in Year 5 and lays off down to $0.3B in Year 6 is magic. Then, starting from THIS table, the costs below are summed all up then divided by 20 to get "annualized" benefit and cost, industry has "annualized" cost for 20 years of around $5B per year, but it most all comes as $40B in year 4-5.

|

| Industry costs $37B in Yr 3-4, then 4B. Patient "value" $26B forever. |

|

| click to enlarge |

How They Did It

I won't try to recount their whole protocol, but they use a lot of simplifying assumptions. I'm simplifying by making up round numbers here. Let's say health care is 10% errors. Let's assume half are lab tests (not MRI's or incorrect dosages in an IV). Let's assume half of lab tests are LDT's. Let's assume if the LDT's were FDA approved, the error rate if LDTs would be halved. They can also get from medical errors avoided to incorrect cancer diagnoses avoided, and then assume the error cost 3.5 years or the correction would gain 3 years. At about $500K per year, that's $1.5M or $2M in value.

I also show these financials alone, in Sidebar 5 of this blog series.

It's Not Just Numbers

I expected the financial supplement to be some summary text and then mostly justifications of the math and inputs, but it's not. The financial supplement is 127 pages long because it recapitulates many, many pages of argumentation found in the proposed rule as well.

Consolidation and Company Exits. They talk about consolidation in the lab industry, due to the rule, leading to higher monopolistic prices (page 89-90). They talk about smaller labs existing the market (page 89) but don't mention that exactly those small labs include venture capital start up labs going top-flight innovation.

If FDA's So Great, How Come Nobody Comes? They wonder one of the things I wondered. The main rule said since 2017, they've had 40 application for FDA approvals for LDTs, and passed 20 of them. This is out of many many thousands of tests. You might wonder, if the benefits of FDA approval or so grand (as they claim), why almost nobody goes voluntarily. This occured to me reading the main rule, and they discuss the same issue at one point in the financial supplement (p 14; they don't have any good answers to this "puzzle" and they don't offer the inference that the FDA stamp might not be so valuable.) You also have to assume, based on the FDA's quotes and arguments, that molecular lab directors know they tests are "wrong" more times than IVD tests and are "hurting people" yet continuing to use the (alleged) LDTs. So the FDA's verbiage directly implies that lab directors are either incompetent or malevent, and causing $30B of deaths and health value loss each year, today, among their patients.

Dislike "Distributed Model Tests." I don't know a lot about it, but I understand CAP has a "distributive model" of review, allowing different parts of a genomic tests to be outsourced among different CLIA labs (deck or deck copy.) FDA writes at length, but only in this financial supplement (p 14), not the primary rulemaking:

FDA is aware that some entities have adopted business practices that claim a connection to laboratories and offer IVDs as LDTs; for example, conventional manufacturers offering home-use test kits as LDTs, software developers offering software without validation for high risk clinical use with LDTs through laboratory partnerships, research use only test kit manufacturers marketing their kits to clinical labs through laboratory partnerships, custom home collection test kit manufacturers that connect entities interested in developing home-use tests with often unspecified laboratories and a platform to scale testing, and contract manufacturers claiming to be consulting firms that design and validate tests for customer laboratories to perform. FDA is concerned that firms are offering IVDs as “LDTs” even when they are not LDTs, because they are not actually designed, manufactured, and used within a single laboratory....[*]

Related? I don't know, but per Genomeweb, FDA concurrently nixed a bid for separately sourced PGx software for LDTs, resulting in a vender exiting the market. Here.

Wild Swings. The FDA makes some "wild swings." For example, as an example of LDT problems, they cite lawsuits over egregious billing for COVID and microbe panel testing. To my knowledge, these had nothing to do with whether an LDT or a Biofire kit was used; they were about (claimed) egregious billing practices. They were about test codes and prices, not tests. There's also some tricky text, such as referring to antibody tests as "possibly totally manual" and not regulated while they become regulated if anything automated is involved.

We're From the Government, Here to Help. FDA comments, briefly, p. 90, that FDA approval may speed up and secure payor reimbursement.

Double Counting or Erasing Lab Costs? Labs will be concerned about their costs, including lab fees. But the accounting doesn't count fees. You see, the fees (hundreds of millions) are just double-entry accounting, a lab cost but revenue for FDA, so they wash out. (-$200M from labs, +$200M to FDA, net zero, just like a ledger in Accounting 101.)

Scale of Rulemaking. The supplement makes clear (and this is noted only-in-passing in the rule) that any estimates of numbers of labs, numbers of tests, or imminent burden on FDA reviewers, are only within a factor of ten. Time after time a number is 2000 to 100,000, mid estimate 25,000 [numbers of that type of range]. This has huge impacts on how FDA can rapidly hire and train thousands and thousands of IVD staff, many of whom will be unnecessary after the grand bolus of tests come through in 2028, 2029.

###

There are a lot more easter eggs in the 127 page document, but that gives a flavor of why it's worth reading.

###

[*] I'm not planning to write it, but a sidebar to this sidebar would discuss the wise separation of parts of a process in different collaborating companies rather than in one vertical, e.g. weaving cloth in New England and making the clothes in New York; making batteries in Cleveland and cars in Detroit; Ronald Coase's "Theory of the Firm" and a range of economic and technological and business school thinking about this corporate division of labor.