Every fall CMS publishes Part B utilization data, by CPT code, for the prior year, on this page:

https://www.cms.gov/Research-Statistics-Data-and-Systems/Downloadable-Public-Use-Files/Part-B-National-Summary-Data-File/Overview

This year, the data for CY2020 is a month or two later than normal, but it's out.

Enjoy! I've put a copy of the lab spending alone in the cloud here.

Note that CMS releases the CY2020 data in numerous successive XLS files. There is no file for the 80,000 series, the lab codes. These are because they are in the file labeled labeled as starting with 0001U, which is actual a complete laboratory and pathology code file, including e.g. PLA ("end with a U") codes. Note the "Begin with U" codes (special CMS COVID codes) are in a separate file, titled "Miscellaneous." For most of the data below, I manually pulled out U0003 U0004 and added them to the CMS lab file starting with "0001U" and including the 80,000 series. Whew.

CMS has not yet released the state-level data files (they will appear here) but they're very tedious to work with since there are 50-plus separate Excel files.

A few tidbits.

Concentration of Category III Codes

In a recent webinar presented at Stanford, AMA staff emphasized that Category III codes were doing well, with several hundred million dollars of annual payments. Yes, but. The payments are highly concentrated. In this CMS data, there are $275M dollars allowed. But out of several hundred Category III codes, the top 2 had 77% of all payments and the top 10 had 95% of all payments. Only about 25 codes were paid more than even $100,000 nationwide in Part B.

Why a pretty old Category III code, 0191T, with >80,000 uses year after year, is not a Cat I code is a mystery to me.

|

| click to enlarge |

Part B Lab Spending

Simplifying by leaving out lines for interpretation or tech component only, I see $6.9B in Part B lab code spending (without COVID) and $7.8B (with COVID PCR).

The largest dollars allowed was U0003/U0004, high throughput COVID testing, at $900M.

Turning to the "regular" CPT codes, the highest path/lab code was 88305 - a surgical pathology code - at 17M services for $860M. Next is molecular unlisted code 81479, with 138,000 services at $290M. (This code is used almost exclusively by MolDx).

For CY2020, code 81408 - rare full length genes nearly never used in the Medicare population before 2018 - was code #9 at $207M (or #8, not counting COVID). Labs cited in alleged-fraud investigation Operation Double Helix almost always billed high amounts of 81408.

Among all lab spending, including COVID, the top 10 codes were 46%.

|

| Top Path/Lab Codes (incl COVID) - Click to enlarge |

Part B Molecular Spending

I quickly sorted for molecular codes 81170-81599 and U-codes (PLA codes). I tally $1.4B in spending (about the same as CY2019) for general codes, and $2.3B when we add COVID PCR as codes U0003-U0004.

Amazingly, given the profusion of hundreds of new molecular codes, the top 8 codes (excluding COVID) take 70% of the spending.

And even more amazingly, 5 of the top 8 codes (excluding COVID) are non specific codes. (!!!)

Among the specific codes, excluding COVID, #1 is Cologuard 81528 at $210M, followed by Oncotype (81519) and Foundation Medicine (0037U) at about $77M each.

Just two nonspecific codes, 81479 and 81408, grossed $400M.

Note, the table below is missing 81162 (BRCA 1&2) at $85M spend and 46,788 services, because I cut the data rows below at 81170 lower bound. (Discovered 5/27/2022). It should be the fourth-highest coce after 81479, 81528, 81408.

|

| MoPath w/o COVID - click to enlarge |

MoPath Data With COVID

Here is the data including the $900M of spending for COVID PCR (U0003, U0004). At $900M, COVID is about 39% of all molecular spending, not far from half.

|

| MoPath "with" COVID U0003-4 (39%, $900M) - click to enlarge |

PLA Codes Incredibly Concentrated

In another blog today, I noted that Cat III codes were incredibly concentrated in the top couple codes among hundreds of codes, and the huge majority of Cat III codes paid little or nothing. (Here).

Same for PLA codes.

In total, PLA codes were paid $127M, however, $90M of that went to the top two codes (FMI CDx and Oncotype Prostate), and of the top two codes, $77M/90M went to FMI CDx.

Only about 20 PLA codes were paid more than even $100,000 (say, the salary of a single sales worker). 95% of PLA spending went to the top ten of over 200 codes, while even that is misleading, since 75% went to the top 2 alone.

|

| click to enlarge |

COVID Code Usage CY2020

Here's a table of the COVID lab code usage. Use of neutralizing antibody tests was almost nil, and use of antibody and antigen tests were only 5% and 2% of payments, respectively. Almost all PCR testing went through the "high throughput" codes for platforms with > 200 tests per day.

CMS spent about $1B in total on COVID testing, and $900M on high volume PCR testing.

|

| click to enlarge |

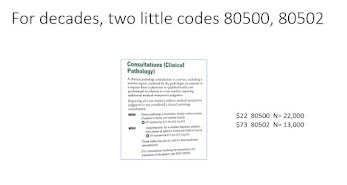

HCPCS Code Trivia

The files include data for all alphanumeric HCPCS codes (e.g. drugs, wheelchairs, full tables here). "S" codes are supposed to be for private payers (on request to CMS for a code) and "T" codes for Medicaid or other federal agencies, not for Medicare. In fact, payments for S and T codes were "zero" at Medicare Part B.